What are Mortgage-Backed Securities (MBS): Discuss Briefly

Oct 25, 2023 By Susan Kelly

Introduction

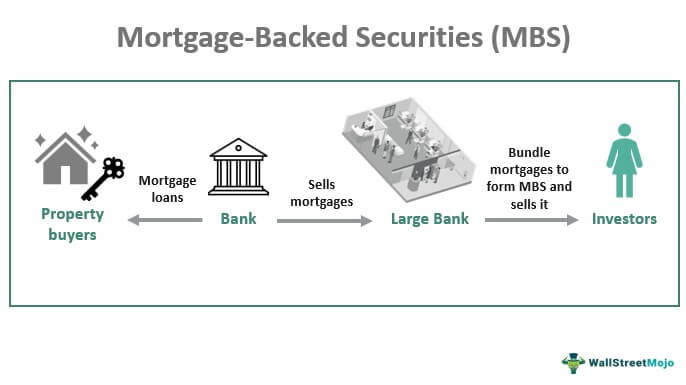

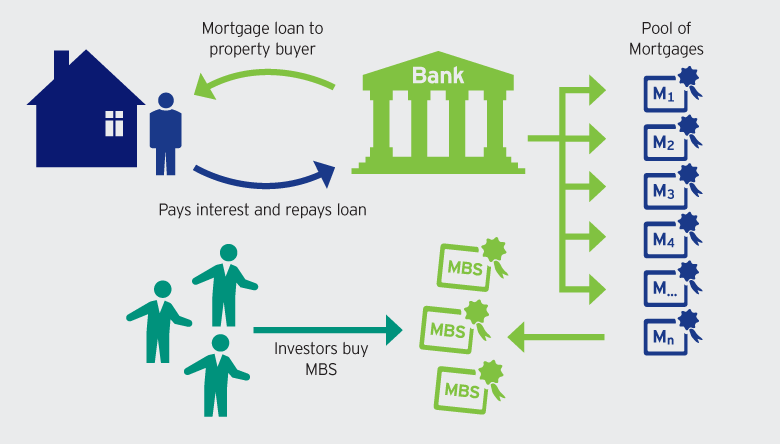

To give one example, mortgage-backed securities are a subset of asset-backed securities. In other words, they are a bond secured by a piece of property, such as a house. 1 The investor is essentially taking over the lender's role by purchasing the mortgage in exchange for monthly payments. Institutional, corporate, and individual investors are the norm for these securities. An investor who bought Mortgage-Backed Securities (MBS) risks losing money if the homeowner defaults on the mortgage.

How a Mortgage-Backed Security Works

Modern mortgage-backed securities were made possible when President Lyndon Johnson signed the 1968 Housing and Urban Development Act, which also established Ginnie Mae. Johnson proposed allowing banks to dispose of mortgages through sales, freeing up capital for other home loans. Thanks to mortgage-backed securities, non-bank financial institutions could enter the mortgage market. Only banks could afford to make long-term loans before MBSs became popular. They were financially stable enough to sit tight until the loans were repaid 15 or 30 years from now.

Lenders could quickly recoup their losses thanks to MBSs, which were first developed to facilitate immediate cash returns from secondary market investors to lenders. Lender participation rose. There were mortgages available that didn't care about the borrower's income or property. Because of this, there is now more competition for conventional banking institutions. As a result, they lowered their standards to remain competitive.

Types of Mortgage-Backed Securities

Mortgage-backed securities come in a few different flavours, but they're all essentially the same thing: bonds. Here are the different types of Mortgage-Backed Securities (MBS).

Pass-Through Participation Certificate

The pass-through participation certificate is the most elementary type of MBS. Mortgage holders get their proportional share of principal and interest payments.

Collateralized Debt Obligation

The market for structured securities became highly aggressive in the early 2000s. To woo new customers, investment banks developed increasingly complex investment products. Collateralized debt obligations (CDOs) were created as examples; they can consist of various loans. These products, which may or may not include mortgages, serve the same purpose for the investor as MBS. Around the time CDOs were created, investment.

Additionally, investment banks created a more intricate mortgage-backed security known as the collateralized mortgage obligation (CMOS). To make these complex investments, a pool of mortgages is divided into segments with similar levels of risk. Regarding default risk and cash flows, the least risky tranches have more certainty, while the riskiest tranches have more uncertainty. Some investors are drawn to the higher interest rates with this increased risk.

Mortgage-Backed Securities: Pros And Cons

Buying mortgage-backed securities is an excellent way to spread risk across a broader range of assets. As an investment that pays out regularly, they may interest those seeking a regular income stream. However, the amounts of these distributions vary, which isn't ideal for investors looking for a steady income stream. Risks associated with collateralized mortgages also apply to MBSs. As a result of refinancing, homeowners may pay back investors their principal amount earlier than expected. Market and liquidity risk are also on the table when purchasing an MBS.

MBS and the Financial Crisis

Mortgage-backed securities were instrumental in triggering the global financial crisis of 2007 that wiped out trillions of dollars in wealth, led to the collapse of Lehman Brothers, and sent shock waves through global financial markets. The rapid rise in home prices and the increasing demand for MBS made it inevitable that banks would relax their lending standards, prompting consumers to rush into the market regardless of the cost.

The Crisis

The origin of subprime MBS can be traced back to that point. As Freddie Mac and Fannie Mae bolstered the mortgage market aggressively, the demand for mortgage-backed securities deteriorated, and ratings became meaningless. Then in 2006, housing costs reached an all-time high. The failure of subprime borrowers to make loan repayments, or "default," became widespread. Because of this, the housing market started its long decline. Foreclosures increased as homeowners realized their properties were worth less than their mortgages.

The value of conventional mortgages, which underpin the MBS market, also fell sharply. Many MBSs and CDOs based on pools of mortgages were grossly overvalued because of the tidal wave of defaults. Losses accumulated as banks and other institutional investors attempted and failed to sell off their bad Mortgage-Backed Securities (MBS) investments. As a result of the subsequent tightening of credit, several banks and other financial institutions came dangerously close to collapse. Because of the halt in lending, the entire economy nearly crashed.

Conclusion

Mortgage-backed securities are sophisticated investments that call for extensive preparation. It would help to verify that the seller is reliable before making purchases. Consulting a financial advisor may be wise if you need assistance finding an MBS that can generate the returns you require. Furthermore, you'll need a sizable sum to purchase an MBS, making these bonds challenging for novice investors. The purchase and sale of mortgage-backed securities continue to this day. Since most people, if given a chance, will opt to keep their current mortgage, the market for such products has revived. The Fed continues to hold a sizable share of the MBS market, albeit one it is working to reduce through incremental sales.

Jan 16, 2024

Banking

Credit Card Tips For Beginners

This article will give an expert view of the best tips to help you use your credit card correctly.

Dec 09, 2023

Banking

How to Get a Car Loan With Bad Credit

Even with bad credit, you may still get a car loan.

Oct 10, 2023

Taxes

The Year 2022's Finest Tax Preparation Guides

Filing your taxes may be a hassle, as the name suggests. There is several paperwork to fill out, and mistakes might have serious consequences. You should review your tax knowledge before tax season since the tax code is continually changing.

Nov 02, 2023

Investment

Investments: What Is It? Avoiding Investing Mistakes the Rich Don't Make

As a group, ultra-high-net-worth persons with at least $30 million (UHNWIs). 1 Stock in private and public businesses, property, and other assets like art, airplanes, and luxury vehicles make these people very wealthy. If you look at these UHNWIs, you might think there's some secret investment strategy you can use to get to their level of wealth. This isn't always the case. On the other hand, they know how to put their resources to work for them by taking calculated risks.

Feb 08, 2024

Investment

Invest in Real Estate for as Little as $1,000

Take the first step towards investing in real estate. We'll show you how to get started and answer any questions about investing in this world with a one-time investment starting at low cost of just $1,000

May 09, 2024

Investment

Pros and Cons Review of Lafayette Life Insurance

Lafayette Finance Life Insurance offers various insurance products, including life and retirement policies.

Oct 11, 2023

Taxes

What Is a Personal Exemption: An Eccentric Guide

Each individual the taxpayer provided was exempt from taxation up to the amount of money set aside for subsistence. To claim personal immunity, the taxpayer must demonstrate that their spouse or dependents meet specific criteria.

May 15, 2024

Mortgages

What’s the Line of Credit (LOC)?

Learn about Line of Credit (LOC) including its definition, types, and real-life examples. Understand how LOCs work and their significance in finance.

Jan 13, 2024

Investment

What is CrowdStreet and How to Use it?

Let’s understand the basics of real estate investing with CrowdStreet. Learn how this platform helps investors to make contributions to the commercial real estate market.

Oct 01, 2023

Banking

Advantages of Money Orders Over Other Payment Methods

Money orders are a secure and cost-effective way of sending money online. They offer complete anonymity for both sender and recipient, as well as pre-payment for the full amount of the transaction, eliminating any risk of bounced checks or fraudulent transactions

Oct 13, 2023

Banking

Definition of Online Bill Pay

Online bill pay is a payment or banking service that allows you to pay your bills online through a bank account, often without cost. It will simplify your finances by removing the requirement to write checks or divide and count the paper currency.

Oct 14, 2023

Mortgages

Client Explanations on Soaring Interest Rates and Real Estate

In a competitive free market, government-backed and private lenders bid against one another for homeowners' business, causing fluctuations in the average monthly mortgage interest rate. Due to stable property prices, tightened lending restrictions, and a decreasing backlog of unsold properties, the average interest rate on 30-year fixed mortgages have remained around historic lows since 201